Get This Report about Best Investment Books

Wiki Article

The Best Investment Textbooks to Read through For newbies

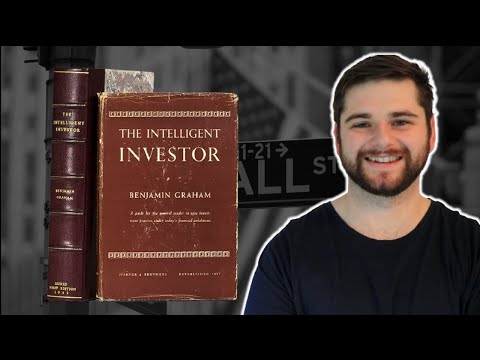

Investing is often overwhelming, but Finding out the terms, jargon, methods and implementations that go along with it will make the practical experience easier. Benjamin Graham (the "father of price investing") wrote this book in 1949 that may be an indispensable go through for those attempting to save and devote their cash sensibly.

This 2019 e-book is good for novices because it distills complex financial commitment topics into quickly understandable chapters.

The Psychology of cash

Best Investment Books Can Be Fun For Everyone

The ideal financial commitment textbooks discuss dollars administration and investing, how to create wise selections with personal savings and investments, and why all Older people (such as Youngsters, teens and youthful adults) should really have a minimum of a basic understanding of investing. These books give an outstanding solution to understand a topic which impacts all our lives - whether it is lawyers, business people, investment bankers, doctors or digital Entrepreneurs; staying fantastic with dollars will advantage you in the course of your vocation journey.

The ideal financial commitment textbooks discuss dollars administration and investing, how to create wise selections with personal savings and investments, and why all Older people (such as Youngsters, teens and youthful adults) should really have a minimum of a basic understanding of investing. These books give an outstanding solution to understand a topic which impacts all our lives - whether it is lawyers, business people, investment bankers, doctors or digital Entrepreneurs; staying fantastic with dollars will advantage you in the course of your vocation journey.Graham and Buffett's timeless common The Smart Investor remains an indispensable guidebook for beginning investors. This typical introduces price investing - which consists of buying firms with strong financials and long-phrase prospective customers at discounted price ranges - by discounted pricing on inventory marketplaces. Also, The Intelligent Trader explores diversification, extensive-term investing horizons, greenback Expense averaging along with other principles important for profitable investing.

Philip Fisher's Typical Perception Investing has extended been viewed as one of several typical investment decision guides. Initially released in 1958, this get the job done gives audience with techniques for choosing shares with possible for top returns making use of solutions much like the Scuttlebutt process (listening in on what competitors say about your goal corporation before making your acquire) or Distinctive conditions (spend money on businesses which pay out dividends on an ongoing foundation).

This short still complete e-book by Aswath Damodaran from NYU Stern University of Business enterprise will educate you ways to value an organization and select shares. By comprehension its concepts of discounted cash flows calculation, modeling shareholder value development, accounting statements and ratio Evaluation.

How Best Investment Books can Save You Time, Stress, and Money.

Quite a few investing books give attention to what to do; The 5 Faults Each and every Trader Would make is designed to aid visitors stay clear of earning pricey mistakes when generating fiscal decisions. It covers several of the most Repeated glitches produced by investors including succumbing to concern and greed and also overconfidence - having time out for looking at this investment reserve may help you save you from some expensive missteps!

Quite a few investing books give attention to what to do; The 5 Faults Each and every Trader Would make is designed to aid visitors stay clear of earning pricey mistakes when generating fiscal decisions. It covers several of the most Repeated glitches produced by investors including succumbing to concern and greed and also overconfidence - having time out for looking at this investment reserve may help you save you from some expensive missteps!The straightforward Path to Prosperity

This reserve aspects how any personal can create wealth via simple nevertheless time-examined methods that need minimal Electrical power or energy. It demonstrates how to evaluate an asset's intrinsic value, diversify their portfolios, and regulate risk - ideas which have proven them selves after a while among today's foremost investors. It is simple to go through, still its timeless rules have had Long lasting impacts amongst today's prime buyers.

This basic expense e book is now among the best-advertising titles ever posted, and once and for all cause: it offers Just about the most comprehensive guides to investing available today. This timeless textual content teaches audience how to analyze corporations, steer clear of problems, and make good investments primarily based on their own person situation and objectives. Additionally, it explores matters not covered somewhere else like housing investments, venture cash funding and hedge fund management administration.

Inexperienced persons seeking to commit ought to look at this e book; it provides a stage-by-move strategy that is very simple and user-pleasant. Kindle Edition fees fewer than 1 dollar, and works by using true-life examples from its writer to indicate how dollars can expand with minimal energy.

Ben Graham supplies insight into his investing philosophy praised by many of the planet's most famed buyers During this common click here book by Ben Graham. His emphasis is on obtaining very low-possibility, superior-return investments with long-phrase probable - while shares can generally fluctuate wildly involving becoming low-cost sooner or later and pricey the following!

Some Known Factual Statements About Best Investment Books

As our oldest investment traditional, this timeless study needs to be on Absolutely everyone's reading through record. It handles fundamentals for instance inventory analysis and selection and also passive investing by way of index funds - advice that has been suggested by outstanding figures like Invoice Ackman, John Griffin, Dan Loeb and Mohnish Pabrai on their own!

As our oldest investment traditional, this timeless study needs to be on Absolutely everyone's reading through record. It handles fundamentals for instance inventory analysis and selection and also passive investing by way of index funds - advice that has been suggested by outstanding figures like Invoice Ackman, John Griffin, Dan Loeb and Mohnish Pabrai on their own!The Outsiders

Within this book, the author displays normal individuals how they can spend like professionals with just a bit guidance. It truly is a perfect investment guide for beginners mainly because it provides plenty here of practical information in an easy-to-read through format. He handles fundamentals for example working with anxiety and greed along with training visitors how to settle on stocks with easy procedures - supporting buyers Create portfolios with higher returns.

This traditional financial investment e-book has existed for decades and remains an indispensable supply for buyers of all ages. The authors examine historic evidence, economics and sector concept to stipulate important facets of productive investing; such as diversification and lower-Price tag investing in addition to how to stop prevalent faults although cultivating disciplined investing tactics.

As new investments may go Mistaken, It can be essential to study through the activities of learn buyers. Several newbie buyers repeat identical errors again and again, but reading expenditure textbooks may help stay clear of these pitfalls. The creator of this e book provides a realistic tutorial for investing dependant on productive fund supervisor procedures; training audience how to pick out profitable stocks by detailing good quality management guidelines focused on high-quality and value.

Traditional books similar to this 1949 publication from Ben Graham continue being timeless classics and should be crucial studying for anybody seeking to grasp the fundamentals of investing. It concentrates on corporation valuation and how to spot undervalued providers which will return considerable returns for investors, when highlighting margin of basic safety factors and benefits of acquiring benefit shares above expansion stocks.

This reserve blends personal finance with historical past to show how the world's prime buyers have created their fortunes as time passes. The creator highlights how profitable investors were being equipped to beat their fears and resist greed's temptations although discussing its impact on economic marketplaces. In addition, this textual content discusses social and political functions' influence around money marketplaces.

The Very little E-book of Common Feeling Investing